Offshore Company Formation: Maximizing Growth Possible

Offshore Company Formation: Maximizing Growth Possible

Blog Article

Strategies for Cost-Effective Offshore Firm Formation

When considering offshore business formation, the pursuit for cost-effectiveness becomes a critical problem for services seeking to broaden their procedures globally. offshore company formation. By exploring nuanced strategies that blend legal compliance, financial optimization, and technical improvements, companies can get started on a course towards overseas company formation that is both financially prudent and purposefully sound.

Selecting the Right Jurisdiction

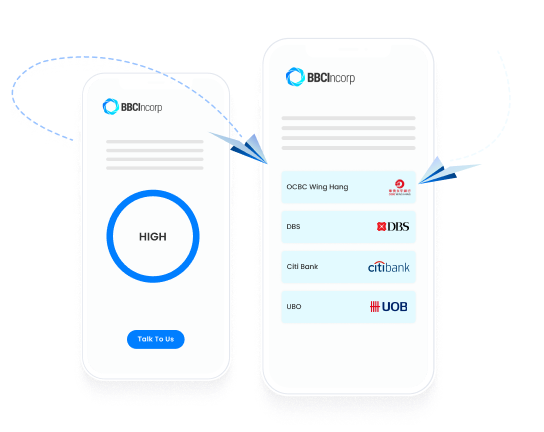

When developing an offshore business, picking the proper territory is an important decision that can substantially influence the success and cost-effectiveness of the formation procedure. The jurisdiction selected will certainly figure out the regulatory structure within which the business operates, impacting taxation, reporting demands, privacy regulations, and general organization versatility.

When picking a jurisdiction for your overseas firm, numerous aspects have to be considered to make certain the choice lines up with your strategic goals. One essential element is the tax routine of the jurisdiction, as it can have a considerable influence on the business's earnings. Additionally, the level of governing compliance needed, the political and financial security of the jurisdiction, and the simplicity of operating needs to all be evaluated.

In addition, the reputation of the jurisdiction in the global service neighborhood is crucial, as it can affect the perception of your company by clients, partners, and banks - offshore company formation. By thoroughly assessing these aspects and looking for expert advice, you can choose the appropriate territory for your offshore company that enhances cost-effectiveness and supports your organization objectives

Structuring Your Company Successfully

To make sure optimal performance in structuring your overseas company, thorough attention should be offered to the business framework. By developing a clear possession framework, you can make sure smooth decision-making procedures and clear lines of authority within the company.

Following, it is necessary to think about the tax implications of the picked framework. Various territories supply varying tax obligation benefits and rewards for overseas companies. By thoroughly analyzing the tax regulations and guidelines of the selected territory, you can enhance your company's tax efficiency and minimize unneeded costs.

Additionally, maintaining proper paperwork and documents is essential for the reliable structuring of your offshore firm. By maintaining accurate and updated documents of economic purchases, business decisions, and conformity files, you can guarantee openness and accountability within the organization. This not just facilitates smooth procedures however additionally aids in demonstrating compliance with regulatory requirements.

Leveraging Technology for Savings

Effective structuring of your overseas company not just hinges on meticulous focus to business structures yet additionally on leveraging modern technology for financial savings. One method to leverage innovation for financial savings in overseas business formation is by using cloud-based services for information storage and partnership. By integrating technology purposefully right into your overseas firm formation procedure, you can attain considerable financial savings while enhancing operational effectiveness.

Lessening Tax Obligation Obligations

Making use of tactical tax obligation preparation methods can properly reduce the financial concern of tax responsibilities for offshore business. One of one important source of the most common approaches for lessening tax liabilities is with revenue moving. By distributing revenues to entities in low-tax jurisdictions, offshore companies can legitimately reduce their general tax obligation commitments. Furthermore, taking advantage of tax obligation incentives and exemptions offered by the jurisdiction where the overseas company is signed up can lead to substantial financial savings.

An additional technique to decreasing tax responsibilities is by structuring the offshore business in a tax-efficient way - offshore company formation. This entails thoroughly creating the possession and operational structure to maximize tax advantages. Setting up a holding company in a jurisdiction with favorable tax legislations can help combine earnings and decrease tax obligation direct exposure.

Moreover, remaining updated on international tax obligation regulations and conformity needs is essential for decreasing tax obligation obligations. By ensuring strict adherence to tax obligation laws and guidelines, overseas business can stay clear of expensive charges and tax obligation conflicts. Looking for specialist advice from tax obligation experts or a fantastic read legal experts concentrated on worldwide tax obligation matters can additionally give valuable insights right into efficient tax obligation preparation techniques.

Making Sure Conformity and Threat Mitigation

Executing robust compliance measures is essential for offshore business to mitigate risks and keep regulatory adherence. Offshore territories frequently deal with enhanced scrutiny because of problems pertaining to cash laundering, tax obligation evasion, and various other economic criminal offenses. To make sure conformity and reduce dangers, offshore business need to perform complete due persistance on clients and service partners to protect against participation in immoral activities. Additionally, executing Know Your Consumer (KYC) and Anti-Money Laundering (AML) treatments can help validate the legitimacy of transactions and secure the firm's credibility. Normal audits and testimonials of economic records are important to recognize any kind of abnormalities or non-compliance problems immediately.

In addition, remaining abreast of transforming regulations and legal needs is important for offshore firms to adjust their conformity practices appropriately. Engaging legal specialists or compliance professionals can supply useful advice on browsing complicated regulative landscapes and guaranteeing adherence to international criteria. By focusing on compliance and danger reduction, offshore firms can enhance openness, build trust with stakeholders, and secure their procedures from potential legal effects.

Verdict

Using calculated tax planning strategies can properly decrease the monetary worry of tax obligation liabilities for overseas companies. By dispersing profits to entities in low-tax jurisdictions, offshore firms can legitimately lower their general tax obligation commitments. Furthermore, taking benefit of tax motivations and exemptions provided by the territory where the offshore business is signed up can result in considerable financial savings.

By ensuring strict adherence to tax legislations and guidelines, offshore firms can prevent pricey fines and tax disputes.In verdict, cost-efficient overseas company formation calls for cautious factor to consider of jurisdiction, efficient structuring, innovation usage, tax minimization, and conformity.

Report this page